The MFSA monitors marketing material published by licensed entities to promote their financial products to protect consumers and maintain a level playing field among regulated firms. Although the publication of such adverts does not require pre-approval by the MFSA, licensed entities are to ensure that prior to issuing such adverts, these are in line with the applicable regulatory requirements. Where, in its monitoring activities, the Authority considers that an advertisement is unfair, unclear or misleading, it reaches out to the relative licensed entity to request adjustments or, at times, withdrawals of non-compliant marketing materials until such time as these amended.

The outcome from the monitoring that has been carried out by the MFSA in 2023 is the focus of the latest edition in the series “The Nature and Art of Financial Supervision”.

Key Findings:

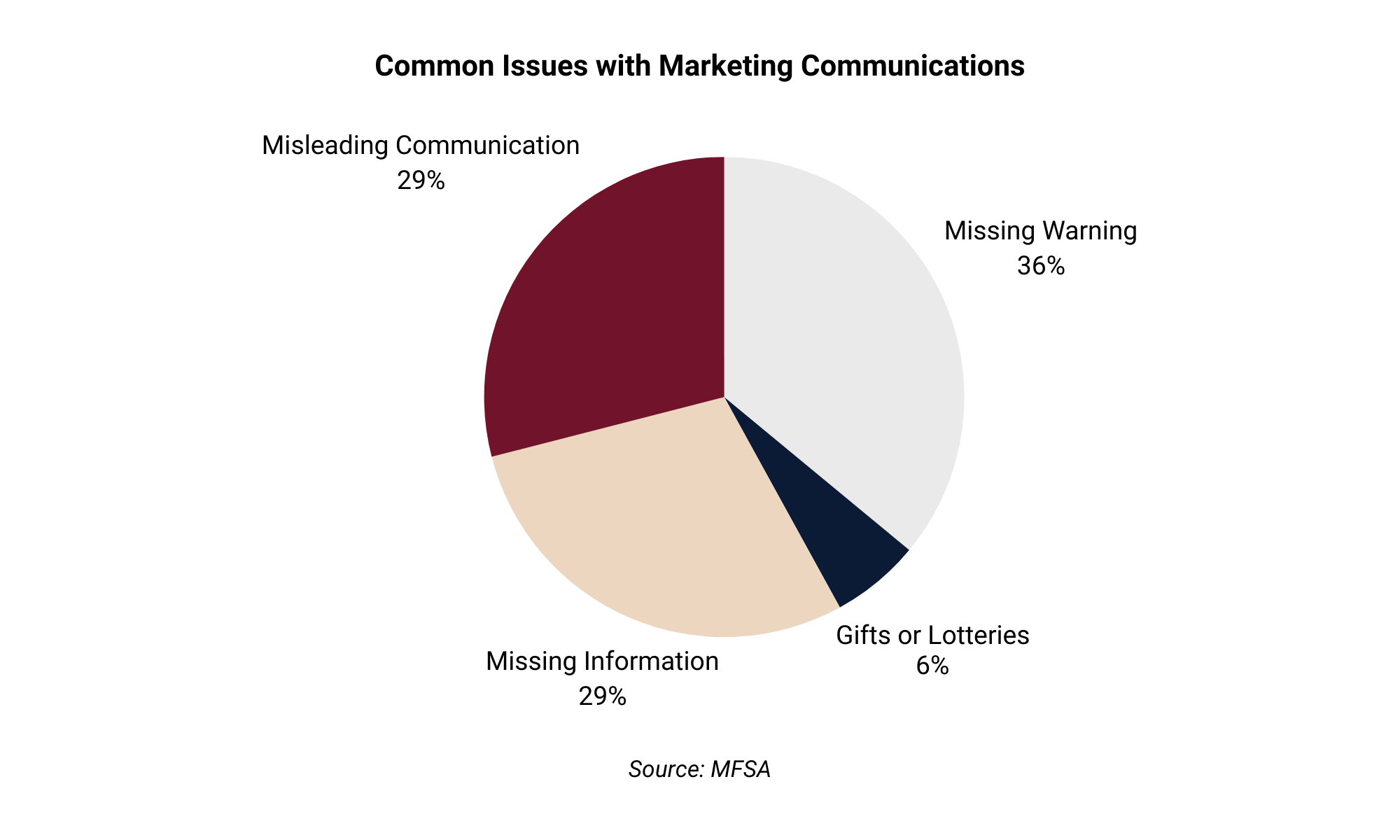

In 2023, the MFSA reviewed 359 social media adverts issued by investment firms, insurance undertakings, and credit institutions. Of these, 40 cases required further clarification, with 30 resulting in amended adverts, and one case resulting in the withdrawal of the marketing communication. The main findings requiring the Authority’s intervention were related to missing information, misleading communication on the nature and the features of the product, missing disclaimers and/or risk warnings, and misleading use of gifts, rewards, or other incentives.

A total of 35 websites were also reviewed, and common issues such as incorrect or incomplete information about EU operations, licensing statements, target audiences, and complaint procedures were identified.

The report highlights an increase in the use of gifts, prizes, and lotteries in financial promotions, emphasising their potential for misleading consumers. The MFSA also observed an uptick in the promotion of Insurance-Based Investment Products (IBIPs) using terms like "guaranteed" without sufficient disclosures about the nature and limitations of such guarantees.

Dr Sarah Pulis Head of Conduct Supervision said: “The MFSA is committed to upholding the highest standards of transparency and integrity in financial marketing. This publication underscores our commitment to protecting consumers by ensuring that marketing communications are clear, fair, and not misleading. The regulation and supervision of financial promotions are crucial for consumer protection, ensuring that consumers are provided with the necessary information from the beginning of their journey to avoid being misled into buying financial products or services that do not meet their objectives, expectations, and needs.”

The document can be accessed here.