Authorisations – Frequently Asked Questions

MFSA Authorisations

What is an MFSA Authorisation?

The Malta Financial Services Authority (‘MFSA’ or ‘Authority’) is the Competent Authority in Malta responsible for the Authorisation and Supervision of persons providing financial services requiring an Authorisation in terms of applicable Regulatory Frameworks currently in force in Malta.

The Authorisation process is a critical part of the Authority’s supervisory framework and each Applicant seeking Authorisation must meet the prescribed requirements set out in the relevant Act and the Regulations and Rules issued thereunder (‘Regulatory Framework’).

The term Authorisation shall have the same meaning as that assigned to it under Rule 4 of the MFSA Act.

Further information on MFSA Authorisation can be obtained from the Authorisation webpage.

Who requires an MFSA Authorisation?

Any person wishing to provide a service falling within scope of legislation administered by the MFSA should meet the minimum regulatory requirements as established by the respective Regulatory Framework at the time of authorisation and on an ongoing basis.

As per the applicable Regulatory Framework, parties intending to offer financial services activities and/or products in or from within Malta may require submitting an application to the MFSA for an MFSA Authorisation.

Prior to undertaking any financial service activity in or from within Malta, you are to assess whether the intended activity/ies requires an MFSA Authorisation or otherwise.

Further information on who needs an Authorisation can be obtained from the following link.

What is Rule 4 of the MFSA Act

Rule 4 of the MFSA Act outlines the MFSA’s Authorisation process, which is triggered when a prospective Applicant submits an intention to submit an Application for Authorisation.

Prospective Applicants should refer to Rule 4 to determine the applicable Authorisation Application Forms. For Applications which are not specified in the Rule, the respective Applications and supporting documentation as stipulated in the respective Regulatory Framework should be submitted.

Rule 4 of the MFSA Act has been issued in terms of Article 16(2)(a) of the MFSA Act and should be read in conjunction with any other Regulatory Framework administered by the Authority and/or in force in Malta, and any regulations and rules issued thereunder.

What is the MFSA Authorisation Service Charter

Prospective Applicants and Applicants shall refer to the MFSA Authorisation Process – Service Charter when determining:

- the Authority’s considerations and expectations applicable to prospective Applicants and Applicants; and

- the timeframes applicable to Applicants for the effective conclusion of the Authorisation process.

The Service Charter also provides guidance on the MFSA Authorisation process and sets out the MFSA’s commitment in return.

The Service Charter is meant to be a starting point when such persons are considering applying for authorisation. It also aims to facilitate the Authorisation process by engaging with Applicants, providing high level guidance, and setting out our expectations in terms of regulatory standards. Furthermore, the document sets out key changes and enhancements affecting the processing of Applications that the Authority has implemented.

MFSA Authorisation Process

What does the MFSA Authorisation process entail?

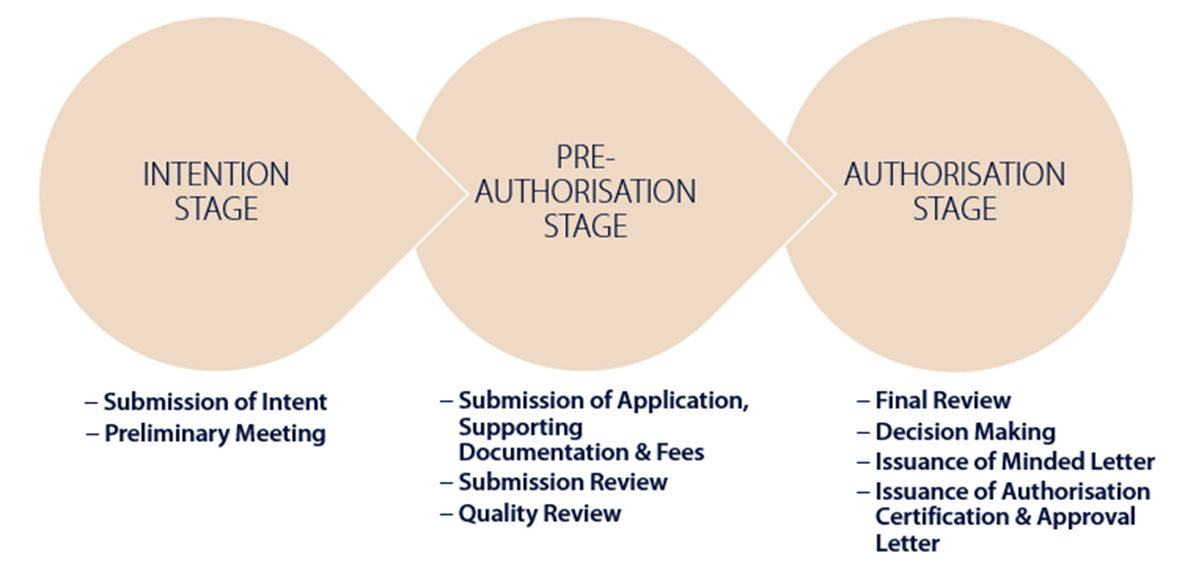

The MFSA Authorisation process consists of the stages as presented in the Figure below:

The process shall be triggered when a prospective Applicant submits an intention to submit an Application for Authorisation.

Further information on the MFSA Authorisation process is available in Rule 4 of the MFSA Act and the MFSA Authorisation Process – Service Charter.

How can I apply for an MFSA Authorisation?

Upon identifying the applicable legislative framework for your business model and familiarising yourself with the applicable Regulatory Framework and the respective obligations, it is strongly recommended you go through the MFSA Authorisation process – Service Charter, the Application Guidelines and Personal Questionnaire guidelines, as applicable. This will introduce you to the MFSA’s Authorisation process and the MFSA requirements and expectations.

As guided in these resources, you can access the necessary information and download the respective forms from the MFSA Authorisation webpage to start compiling the necessary information and documentation required for the submission of Intent to officially kick off the Authorisation process.

Do I need to submit an Application for activities and/or products which are covered by different Regulatory Frameworks?

Provided that the applicable Regulatory Frameworks allow for a Person to hold multiple Authorisations, you would be generally required to submit an application pack for each Authorisation being sought. This said, in the event your business model requires multiple authorisations it is recommended that you contact the respective MFSA Authorisation Team/s to obtain further guidance in this regard and coordinate the submission of the applicable documents.

Can my Application be Withdrawn by the MFSA?

Yes. The MFSA Authorisation Process – Service Charter (link), specifies certain instances in which the MFSA may involuntarily withdraw the Application.

Authorisation Timelines

How long does an MFSA Authorisation process take?

Annex 1 of the MFSA Authorisation Process – Service Charter outlines the timeframes applicable to Applicants for the effective conclusion of the Authorisation process and the MFSA’s commitment in return.

An effective and timely Authorisation process is highly dependent on the comprehensiveness, the quality of the Application pack and the extent of responsiveness and co-operation of the Applicant in relation to issues raised and requests made by the MFSA throughout the Authorisation process.

Are the MFSA time commitments stipulated in the Authorisation Process - Service Charter fixed?

While the Authority is committed to meet the timelines stipulated in the MFSA Authorisation Process – Service Charter, circumstances may arise where it may not be possible to do so. In this regard, the Charter highlights also several of such possible circumstances which may result in unforeseen delays beyond the MFSA’s and/or the Applicant’s control.

Where can I see the expected Authorisation timelines?

Annex 1 of the MFSA Authorisation Process – Service Charter, includes the time commitment the MFSA expects from you and its time commitments return.

How can I avoid unnecessary delays?

- Preparation

Be aware of all regulatory obligations relating to the Authorisation being sought. Prior to the Submission of Intent, you should ideally make sure that you have a solid vision on the business model and have identified suitable candidates up to the MFSA’s standards for all key functions. Ensure that any due diligence is complete, and all the necessary information is gathered. Following the Intention phase, ensure that the Application and all respective MFSA Annexes and other attachments are complete. Where original signatures are required, ensure that these are circulated in a timely manner and filed with the MFSA to the attention of the applicable Supervisory Function.

- Clarity

Avoid generic and vague descriptions (in sections relating to inter alia, the business model, activities, policies, etc.) which are not specific to the Authorisation being applied for. Ensure that descriptions provided clearly relate and explain the Applicant’s business.

- Compliant

Ensure that all regulatory obligations are being met. Where applicable, it is important that the Applicant has all the required safeguards and controls in place, identifies the key risks and any conflicts of interest, and explains how these shall be managed and/or mitigated. The Applicant is expected to demonstrate and provide sufficient comfort that upon successful authorisation, it will satisfy all regulatory requirements at all times.

- Transparent and Co-operative

The Applicant ‘s openness and co-operation with the Authority, both in its clarity and timeliness to its responses, play a crucial role in the Authorisation process’ efficiency.

Exemptions from Authorisation

Are there any exemptions from authorisation requirements?

Certain Financial Services Activity/ies may be provided without requiring an Authorisation from the MFSA. However, Natural Persons and/or Legal Persons intending to avail themselves of such exemptions would need to inform the Authority accordingly.

Reference shall be made to the applicable Regulatory Framework and the respective Exemption Regulations, as applicable.

More information can be found within the respective Regulatory Framework webpages.

Are exemptions from an MFSA Authorisation Requirement automatically operative?

No. Persons intending to avail themselves of applicable exemptions from Authorisation would need to inform the Authority accordingly.

Reference shall be made to the applicable Regulatory Framework and the respective Exemption Regulations, as applicable.

More information can be found within the respective Regulatory Framework webpages.

Authorisation Application Forms

What constitutes an Authorisation Application Form?

The MFSA Authorisation Application Form is the main document. This is complimented by several other MFSA Annexes to the Application Form and Personal Questionnaires. In addition, the Application may request for additional documentation. Applicable MFSA Annexes differ between Application Forms, depending on the Authorisation being sought.

Refer to the MFSA Authorisation webpage for the Application and Annexes applicable for the respective Authorisation.

Can I submit an MFSA Authorisation Application Form which is not part of the new Applications found on the MFSA Authorisation webpage?

The AU Service Charter, together with the New AU Applications and the Application submission process through the LH Portal will come into force from 1 July 2021.

Nonetheless the implementation of the revamped Authorisation process includes a Transition Period. Thereby, the MFSA shall accept old Applications up until 31 August 2021. As of 1st September 2021, the MFSA will only accept the new Applications.

Note that despite the old Applications will be accepted till end of August 2021, submission must be done via the LH Portal using the ‘Application Type’ drop-down option which corresponds to the respective Application and Authorisation type (new Application codes should be ignored in such case).

Can I use an MFSA Authorisation Application document I or my service provider downloaded a few months ago?

Before filling in an Application Form or an MFSA Annex, you are required to ensure that the forms you have are the latest available on the MFSA website. Each document has a version number within it to help track updates (refer to footer of document in each page).

Why can’t I find the Application corresponding to my Authorisation in the new MFSA Authorisation webpage?

You should refer to Rule 4 of the MFSA Act to determine which Applications can be found on the new MFSA Authorisation webpage.

Applications which are not specified in Rule 4, have not yet been updated. In such instances you are to refer to the applicable webpage within the Firms section of the MFSA website to access the necessary Application/s and supporting documentation.

The MFSA will continue to publish new and/or updated Applications supporting the Authorisation process and its sub-processes, as it may deem necessary.

You should monitor the MFSA website for any developments with regards to updates in any Application.

Why is the Application Form not functioning well?

The Authorisation Application Forms, together with the applicable MFSA Annexes to the Application Forms, are supported by Microsoft Office 2013 suit onwards.

Note that although certain programme applications may still access and be seemingly compatible with Microsoft Word documents, they may jeopardise the integrity of the contents within the respective Word documents. In this regard, where programme applications other than Microsoft Word are utilised, you are to ensure that the integrity of the downloadable document is fully maintained.

With respect to information on certain functionalities of the Application, more information can be found in the Authorisation Application Forms Guidelines.

Where can I find more information on the compilation of the MFSA Application Form?

Each Application Form contains high-level guidelines and in-line notes. However, you should also refer to the Authorisation Application Forms Guidelines and these FAQs to obtain further clarity on certain questions and aspects of the Application Form and process.

Should you still encounter any difficulties in interpreting a particular question, contact the relevant Authorisation Team.

Authorisation Requirements

What do I need to know and do before applying for an MFSA Authorisation?

The MFSA consistently aims to guide and provide feedback on Regulatory Frameworks falling within its remit and its approach and processes thereto. This said, you are expected to refer to the information available on the MFSA’s website and be knowledgeable of the relevant regulatory obligations set out in the applicable Regulatory Frameworks and where necessary seek professional advice.

What level of information is expected in the MFSA Application Pack?

The MFSA expects clear information relating to, inter alia: (1) the Applicant’s profile and shareholding, (2) activities and methods of operations, (3) governance set up, key function holders and resources, (4) safeguards, systems and controls, including the respective key policies and procedures (5) financial planning and source of funds documentation, including any capital raising plans, and (6) solid plan how it will satisfy all regulatory obligations upon Authorisation.

Where applicable, the Applicant is required to also have the necessary information and conclusions of its due diligence assessments on the proposed individuals, entities, and/or service providers.

The above is only a high-level indication of what is required by the Applicant. The MFSA Authorisation Process – Service Charter, provides a more comprehensive outlook of the MFSA’s expectations with respect to the nature of information and level of detail it requires from an Applicant. It is thus crucial that you obtain a clear understanding of the Charter before compiling an Application.

Section 3.2.2 also sets out the expected level of information you should already have in your Statement of Intent.

Do all MFSA Authorisation and MFSA Applications have the same requirements?

Each sector has a dedicated Applications Form to cater for the requirements emanating from the respective Regulatory Framework. Therefore, Application Forms contain questions and requirements which are sector specific and others which are applicable cross sectoral.

Do I need to have all Policies and Procedures drafted at Pre-Authorisation Stage?

Where the applicable Regulatory Framework does not require you to have a comprehensive or final Policy and Procedure (‘P&P’) at Pre-Authorisation stage, you are expected to have concluded the structure of the key P&Ps, including clarity what each P&P will cover and a have general indication of the approach that will be adopted.

Do I need to have identified all key personnel at Pre-Authorisation Stage?

You are expected to have identified all the proposed key function holders and requested each individual to complete and submit the MFSA Personal Questionnaire, prior to the submission of the Application pack.

What is the MFSA Personal Questionnaire (‘PQ’)?

The Personal Questionnaire is an official webform required by the MFSA to obtain information on individuals holding positions which can influence the direction of a Legal Person or occupy certain positions of trust, including inter alia: members of the management body, key function holders and qualifying shareholders. The MFSA only approves proposed persons when they are found to be fit and proper to hold the proposed role(s).

More information on the PQ can be found through the following link.

What is the procedure to register a company which shall be performing an MFSA regulated activity?

Companies are to be registered with the Malta Business Register (‘MBR’) in the usual manner. Prior to submitting the documentation for incorporation, you may be required to conduct a legal assessment which specifies whether the activity requires and MFSA Authorisation or otherwise. Information in this respect may be obtained from the MBR. Where a legal assessment is undertaken, this is to be also submitted with the Application Form. Note that certain Regulatory Frameworks specifically require a legal assessment and is thus not optional.

Application Submission

How do I submit an MFSA Authorisation Application?

The Authorisation Application Form and respective MFSA Annexes and documentation is to be submitted via the MFSA LH Portal. Applicants who do not have access to the LH Portal would need to register first. For more information on LH Portal Registration visit the following link.

More information on the Application submission is found in Title 2 of the Guidelines to the Authorisation Application Forms.

Together with the Application submission, you are required to pay the Application fee. Refer to the next section for more information on the Application Fees.

How do I setup an MFSA LH Portal Profile?

You can access and register on the MFSA Licence Holder Portal.

For more information visit the MFSA website.

What constitutes a Complete Submission?

The MFSA assess the completion of an application in a two-tier approach in the Pre-Authorisation Stage:

- Submission Review – this focuses on a high-level check of the applicable Application and supporting documentation required, including the Application Fee.

- Quality Review – the MFSA will initiate its fit and proper assessments and the qualitative scrutiny of the Application and supporting documentation submitted.

Further information on the completeness assessment can be obtained in Rule 4 of the MFSA Act and the MFSA Authorisation Process – Service Charter.

I am trying to submit an old application through the LH Portal but cannot find the respective code

Submission of old Applications shall be accepted up until 31 August 2021. When submitting an old Application through the LH Portal, you are to select the Application Type option which corresponds to the respective Application you are submitting (new Application codes should be ignored in such case).

Will the MFSA accept a staggered Application submission, providing info in multiple iterations?

No. The MFSA expects you to collect and submit all pertinent documentation in one instance, rather than in a piecemeal fashion. This will contribute towards a more efficient and effective process.

Application Fees

How can I pay the Application Fee?

Application fees may be made either through (i) cheque, which should be made payable to the “MFSA” or “Malta Financial Services Authority”, or (ii) bank transfer using either of the following details:

| Bank | Bank of Valletta plc |

| Address | 229, Fleur-De-Lys Road, Birkirkara BKR9069, Malta |

| IBAN | MT06VALL22013000000015803811041 |

| BIC | VALL MT MT |

| Bank | HSBC Bank Malta plc |

| Address | 1, Naxxar Road, Birkirkara BKR 9049, Malta |

| IBAN | MT64MMEB44277000000027070457001 |

| BIC | MMEB MT MT |

Is the Application Fee refundable?

No. The application fee is non-refundable.

Are there Authorisation & Supervisory Fees?

Yes, applicable Authorisation and Supervisory fees can be found within the respective Regulatory Frameworks.

MFSA Contact Point

How can interested parties reach out to the MFSA?

The first point of contact for prospective Applicants shall be the Authorisation Team within the respective Supervisory Functions.

Information on the respective Supervisory Function and Team responsible for the reviewing of the Application is identified in Table 3-1 of the MFSA Authorisation Process – Service Charter.