Financial Stability

The Financial Stability Function performs the monitoring and analysis of the soundness and stability of the financial services system and in the process identify pockets of vulnerabilities that may heighten risks and reduce the level of resilience within the system. These risks are assessed in terms of their extent to propagate across the financial sector, thus becoming a systemic risk, and possibly onto the real economy. A cross-sectoral monitoring approach is applied within the functions’ risk oversight, although specific attention is given to individual or group of institutions which have a large systemic footprint.

The Authority is formally mandated by Article 4(b) of the Malta Financial Services Authority Act to safeguard financial stability in collaboration with the Central Bank of Malta.

(1/6) 2026 O-SII Statement of Decision

The MFSA, together with the Central Bank of Malta have re-confirmed Bank of Valletta p.l.c., HSBC Bank Malta p.l.c., MDB Group Limited, and APS Bank p.l.c. as Other Systemically Important Institutions (O-SIIs) and communicated the corresponding capital buffer rate each must meet.

| Credit Institution | O-SII Score (bps) | Fully-Loaded O-SII Capital Buffer Rate |

| Bank of Valletta p.l.c. (BOV) | 2,849 | 2.00% |

| HSBC Bank Malta p.l.c. (HSBC MT) | 1,431 | 1.25% |

| MDB Group Limited (MED) | 1,264 | 1.00% |

| APS Bank p.l.c. (APS) | 796 | 0.50% |

The O-SII buffer consists of a capital surcharge which is applied to institutions that, due to their systemic importance, are more likely to create risks to financial stability. This capital buffer is applied to domestic systemically important institutions to enhance their resilience by increasing their loss absorbing capacity, thereby ensuring that these institutions pose reduced risk to the domestic economy.

O-SII Statement of Decision, 14 August 2025

See also:

(2/6) 2025 O-SII Statement of Decision

The MFSA, together with the Central Bank of Malta have re-confirmed Bank of Valletta p.l.c., HSBC Bank Malta p.l.c., MDB Group Limited, and APS Bank p.l.c. as Other Systemically Important Institutions (O-SIIs) and communicated the corresponding capital buffer rate each must meet.

| Credit Institution | O-SII Score (bps) | Fully-Loaded O-SII Capital Buffer Rate |

| Bank of Valletta p.l.c. (BOV) | 2,921 | 2.00% |

| HSBC Bank Malta p.l.c. (HSBC MT) | 1,498 | 1.25% |

| MDB Group Limited (MED) | 1,374 | 1.00% |

| APS Bank p.l.c. (APS) | 748 | 0.50% |

The O-SII buffer consists of a capital surcharge which is applied to institutions that, due to their systemic importance, are more likely to create risks to financial stability. This capital buffer is applied to domestic systemically important institutions to enhance their resilience by increasing their loss absorbing capacity, thereby ensuring that these institutions pose reduced risk to the domestic economy.

O-SII Statement of Decision, 8 August 2024

See also:

(2/5) EU Non-Bank Financial Intermediation Risk Monitor 2024

The European Systemic Risk Board (ESRB) has published the EU Non-bank Financial Intermediation Risk Monitor 2024 (NBFI Monitor). This edition of the annual series highlights the key cyclical and structural risks associated with non-bank financial intermediation, specifically investment funds and other financial institutions (OFIs), in 2023.

The NBFI Monitor 2024 also provides an assessment of risk in the crypto ecosystem. Although the crypto ecosystem is exposed to certain unique risks, the business models of a number of crypto-asset intermediaries resemble those of regulated financial institutions. These businesses tend to offer services such as crypto-asset trading, investing, lending and borrowing. Accordingly, they engage in essentially the same activities as traditional financial actors, i.e. credit intermediation, liquidity and maturity transformation in addition to using leverage, while remaining less advanced in terms of regulatory coverage. Crypto-assets and associated intermediaries are covered in the report insofar as the type of financial intermediation they provide is exposed to similar risks and vulnerabilities to those faced by traditional non-bank intermediaries such as investment funds and OFIs.

See also:

- Macroprudential Policies for Non-Bank Financial Intermediation (NBFI) (European Commission)

- Global Monitoring Report on Non-Bank Financial Intermediation 2023 (FSB, December 2023)

- Key Linkages between Banks and the Non-Bank Financial Sector (ECB, Financial Stability Review, May 2023)

- Nonbank Financial Sector Vulnerabilities Surface as Financial Conditions Tighten (IMF, April 2023)

(3/6) DBRS Confirms Malta at A (High); Stable Trend

The stable outlook reflects Morningstar DBRS’ view that the risks to Malta’s credit ratings remain balanced, with a resilient financial sector supported by a strong solvency position and overall ample liquidity buffers; since the last review, banks’ profitability was boosted further, mainly driven by higher net interest income, while pockets of vulnerability are mainly related to banks’ sizeable credit exposure to the housing market, a large part of which relates to residential real estate.

(The above is an excerpt from the DBRS note; the full report should be read if an evaluation/assessment etc. is to be undertaken)

DBRS Ratings, April 2024; Read the Full Report for More Details

See also:

- Fitch Affirms Malta’s A+ Rating with Stable Outlook (Fitch Ratings, March 2024)

- Moody’s Affirms Malta’s A2 Rating with Stable Outlook (Times of Malta, November 2023)

(4/6) Fitch Affirms Malta at ‘A+’; Outlook Stable

Fitch Ratings has affirmed Malta’s Long-Term Issuer Default Rating (IDR) at ‘A+’ with a Stable Outlook.

Malta’s rating is supported by high per-capita income, high potential and actual growth rates and euro area membership. These strengths are balanced against its large banking sector, the small size of its economy, which is highly vulnerable to external developments, and a recent deterioration in public finances with large fiscal deficits, which have led to an increase in the moderate public debt burden.

Financial stability is supported on a sound banking sector. Bank balance sheets are strong, with high levels of liquidity and strong capitalisation, while leverage is low and non-performing loans are low.

Fitch Ratings, March 2024 – Read the full report for more details.

See also:

- Moodys Affirms Malta’s A2 Rating with Stable Outlook (Times of Malta, November 2023)

Macroprudential Oversight

ESRB Recommendations and Warnings

Research Papers

Macroprudential Oversight

Beyond the individual soundness of financial institutions, adverse developments and interlinkages within the financial system can generate and propagate risk within and across national boundaries leading to instability and financial crises.

Against this backdrop, financial supervision must not only ensure the prudential soundness of individual institutions but safeguard against systemic risk and financial instability.

- Institutional Organisation And Objectives

- Macroprudential Instruments

- Macroprudential Decisions

- Reciprocation of Measures

- Emerging Risks

The overall objective of Macroprudential Oversight is to preserve confidence at an acceptable level in financial institutions, markets, and infrastructure, with the aim of maintaining financial stability through a number of key mechanisms, policies and frameworks.

What is Macroprudential Policy?

Macroprudential policy aims to strengthen the resilience of the financial system as a whole, through the implementation of a set of policies that discourage licence holders from undertaking risky behaviour and hence mitigate the build-up of systemic risks within the financial system. Macroprudential policy therefore complements supervision of individual institutions (microprudential supervision), delving into risks and vulnerabilities which have the potential to have system wide effects, analysing interconnectedness, among individual institutions and sectors, and implementing policies based on system wide indicators.

Institutional Organisation

In the aftermath of the Great Financial Crises in 2008, the European Union (EU) introduced a new dimension to the financial supervisory framework, macroprudential supervision, with a complete overhaul of the regulatory architecture implemented between 2010 and 2014; thus in 2010 the European System of Financial Supervision (ESFS) was set up, which included the following macroprudential elements:

- in 2010, the creation of the European Systemic Risk Board (ESRB) to oversee the macroprudential supervision of the EU Financial System [Regulation (EU) No 1092/2010], and

- in 2012, the creation of the national macroprudential authorities [ESRB/2011/3 (2012/C 41/01)];

- in 2013, the identification of intermediate macroprudential objectives and measures to address them [ESRB/2013/1 (2013/C 170/01)] were established; and

- the European Central Bank (ECB) was designated to monitor macroprudential measures implemented by the national authorities (EU No 1024/2013).

The incorporation of macroprudential elements within the EU financial sector regulation was achieved through the implementation in 2013 of the Capital Requirements Directive [CRD IV – Directive 2013/36/EU of The European Parliament and of The Council of 26 June 2013] and the Capital Requirements Regulation [CRR – Regulation (EU) No 575/2013 of The European Parliament and of The Council of 26 June 2013]. In fact, although such capital framework remained predominantly microprudential in nature, it clearly outlined the need of adopting macroprudential policies. Since then significant effort has been devoted towards the calibration of prudential tools. This ultimately resulted in the amendment to the CRD IV and the CRR in 2018, with the intention to make the banking system safer by complementing key policy initiatives taken on risk sharing – notably the European Deposit Insurance Scheme (EDIS) and the Single Resolution Fund. These have been incorporated under the Single Rulebook, that is the backbone of the banking union and of financial sector regulation in the EU in general.

European Systemic Risk Board (ESRB)

The ESRB is responsible for the macroprudential oversight of the EU financial system and the prevention and mitigation of systemic risk. It includes representatives from the European Central Bank (ECB), the European Supervisory Authorities (ESAs), the national central banks and national supervisory authorities among its members.

The Central Bank of Malta and the Malta Financial Services Authority are both members of the ESRB.

Joint Financial Stability Board (JFSB)

At the national level, the Malta Financial Services Authority and the Central Bank of Malta collaborate through the Joint Financial Stability Board (JFSB). The Ministry for Finance (MFIN) also participates in JFSB as an observer. The JFSB has the function of facilitating co-operation between the relevant authorities in matters impacting financial stability. The JFSB is constituted in terms of the ESRB Recommendation ESRB/2011/13 on the macro-prudential mandate of national authorities as transposed in the Central Bank of Malta Act.

Among its responsibilities, the JFSB is empowered to formulate policy recommendations designed to safeguard the stability of the financial system, and to identify and assess macro-prudential instruments, and relevant micro-prudential instruments, required to be implemented to mitigate or control potential systemic and other risks to the system.

Within the context of this institutional framework, the MFSA has developed its capacity to monitor and assess the build-up and impact of potential risk in the financial services sector and support the technical evaluation of systemic and other risks within the ambit of the JFSB, including the implementation of policy recommendations via the relevant micro- and macro-prudential instruments.

Policy Objectives

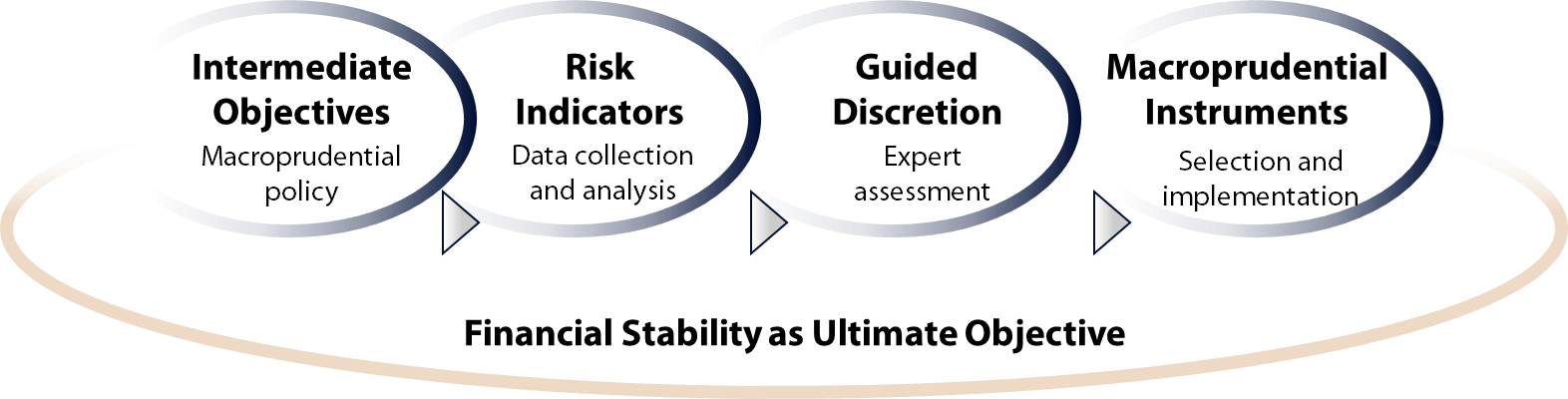

The ultimate policy objective is to preserve Financial Stability. To reach this ultimate objective, a macro-prudential policy strategy defines operative intermediate objectives and relates them to a set of indicators and instruments. Indicators help identify the risks and assess their severity, while the instruments help mitigate the materialisation of these risks.

The ESRB has issued a Recommendation on intermediate objectives and instruments of macroprudential policy (ESRB/2013/1) that constitute an analytical bases for the assessment of the macroprudential risks to the financial sector, guiding the selection of measures for risk prevention and the monitoring of their effectiveness.

The intermediate objectives of national macroprudential authorities should include the following:

- to mitigate and prevent excessive credit growth and leverage,

- to mitigate and prevent excessive maturity mismatch and market illiquidity,

- to limit direct and indirect exposure concentrations,

- to limit the systemic impact of misaligned incentives with a view to reducing moral hazard.

- to strengthen the resilience of financial infrastructures.

Each intermediate objective of macroprudential policy can be managed using one or more instruments based on the regulations of the Capital Requirements Directive [CRD IV – Directive 2013/36/EU of The European Parliament and of The Council of 26 June 2013] and the Capital Requirements Regulation [CRR – Regulation (EU) No 575/2013 of The European Parliament and of The Council of 26 June 2013].

The Financial Stability function within the MFSA – Risk indicators and Guided discretion

The Financial Stability function within the MFSA is responsible for the monitoring and analysis of the risk and vulnerabilities within the financial sector. In carrying out this regular analysis, it formulates an expert assessment of the financial sector soundness, after interfacing with the Authority’s microprudential supervisory functions of the Authority at the operational level, ensuring that all relevant information is shared across all areas of regulation and sector-specific supervision. This type of ongoing interaction ensures that the macroprudential risk outlook is taken into account in the relevant supervisory risk models and supervisory programmes, while facilitating a two-way flow of qualitative information (i.e. from microprudential supervision to macroprudential supervision and viceversa).

The team responsible for macro-prudential oversight and analysis utilises both quantitative and qualitative techniques in order to unveil pockets of vulnerabilities within the financial system (banking, insurance, and investment funds sector). Quantitative tools used to carry out this mandate include early warning risk models, stress indices as well as other financial and econometric models and business intelligence technology. Qualitative surveys are also carried out with other supervisory teams in order to integrate within the risk analysis framework analysis of on-site and off sites reviews carried out at a micro-prudential level.

Macro prudential policies are designed to increase the resilience of the financial system, allowing it to withstand economic shocks, improve its risk management and ensure a steady flow of credit during economic downturns. The following instruments form part of the supervisory tool kit currently available to address systemic risk build-up:

To preserve banks’ capital

- Capital conservation buffer (CCoB) is a capital buffer of 2.5% of a bank’s total exposures that needs to be met with an additional amount of Common Equity Tier 1 capital. The buffer sits on top of the 4.5% minimum requirement for Common Equity Tier 1 capital.

When a bank breaches the buffer, automatic safeguards apply to limit the amount of dividend and bonus payments it can make.

To mitigate and prevent excessive credit growth and leverage

- Countercyclical capital buffer (CCyB)

- Sectoral capital requirements (including intra-financial system)

- Macroprudential Leverage ratio

- Borrower Based Measures: Loan-to-value (LTV), Loan-to-income (LTI), and Debt-service-to-income (DSTI) ratios

To mitigate and prevent excessive maturity mismatch and market illiquidity

- Liquidity coverage ratio (macroprudential adjustment to the liquidity ratio)

- Net stable funding ratio (macroprudential restrictions on funding sources)

- Loan-to-deposit ratio (macroprudential un-weighted limit to less stable funding)

- Margin and haircut requirements

To limit direct and indirect exposure concentration

- Large exposures restrictions

- Clearing requirements for central counterparties (CCPs)

To limit the systemic impact of misaligned incentives with a view to reduce moral hazard

- Capital surcharge for systemically important institutions:

- G-SIIs (global-systemically important institutions) buffer

- O-SIIs (other systemically important institutions) buffer

To strengthen the resilience of financial infrastructures

- Margin and haircut requirements on CCP clearing

- Increased Disclosure

- Structural Systemic risk buffer (SyRB) [(ESRB/2013/1) (2013/C 170/01)]. Regulated in art. 133-134 CRD IV, aims to mitigate systemic risks arising from interlinkages across financial institutions and concentrated exposures (large exposures). The SyRB can be implemented in a differentiated manner for single banks or sets of banks, as well as across subsets of exposures, the latter being known as sectoral Systemic risk buffer (sSRyB).

Other Systematically Important Institutions (O-SIIs)

O-SII Statement of Decision – 14 August 2025

O-SII Statement of Decision – 8 August 2024

O-SII Statement of Decision – 11 January 2024

O-SII Statement of Decision – 16 January 2023

O-SII Statement of Decision – 17 January 2022

O-SII Statement of Decision – 12 February 2021

O-SII Statement of Decision – 20 January 2020

O-SII revised methodology (2020) – Policy Document

When a country applies a macroprudential measure, this may affect directly or indirectly other countries. The ESRB established a reciprocation system with exposure-based measures receiving equal treatment in different EU countries does eliminating the possibility of uneven applicability.

The reciprocity framework consists of the Recommendation ESRB/2015/2, Article 5 of Decision ESRB/2015/4, and Chapter 11 of the ESRB Handbook on operationalising macroprudential policy in the banking sector. The framework was amended by Recommendation ESRB/2017/4 to consider institutions which have non-material exposure and accordingly can be exempted.

Reciprocation can either be automatic or voluntary. EU countries are required to inform the ESRB of such initiatives. Following a review, the ESRB ultimately decides whether to endorse such recommendation under its reciprocity framework.

A comprehensive list of the reciprocation requests can be seen in the following ESRB website https://www.esrb.europa.eu/national_policy/reciprocation/html/index.en.html

More information regarding the reciprocations requested and implemented by Malta can be found in the specific section of this website for the ESRB recommendations and warnings.

Climate Change

This section brings together information relevant to financial stability on Climate-related and Environmental risks (C&E risks) from a macroprudential perspective, complementing the microprudential (e.g., Environmental, Social and Governance (ESG) principles) risk. The macroprudential risk assessment is looking at the large-scale risk of economic and financial damage to both financial and non-financial firms arising from: (i) the transition to a less polluting economy (mainly, but not exclusively, a shift in the energy mix); and (ii) the physical impacts of, inter alia, unexpected extreme natural events and/or changes in the average temperature with relevant effects on economic/productive activity.

Crypto-Assets

A crypto-asset (both unbacked cryptos and stablecoins) is a (private sector) digital representation of a value or a right which may be transferred and stored electronically, using Distributed Ledger Technology (‘DLT’) or similar technology. Characterised by abrupt re-pricing dynamics in the crypto-asset market and a continuous growth of the crypto universe in terms of (i) market size (significant scale up transaction volume) and (ii) degree of interconnectedness with the traditional financial sector, crypto-assets could become a source of potential risks to financial stability.

- The Nature and Art of Financial Supervision, Volume II: VIRTUAL FINANCIAL ASSETS, VFA AGENTS, VFASPS AND IVFAOS

- The Nature and Art of Financial Supervision, Volume VIII: VIRTUAL FINANCIAL ASSETS, AN UPDATE

Cyber Risk

Cyber-attacks can result in financial losses due to operational disruptions, data theft, ransomware payments, unauthorised transactions, reputational damage and potential legal claims. The growing importance of cyber threats, which are becoming more frequent and severe each year, amid a trend of accelerated widespread adoption of digital tools and products in the financial services industry, poses increasing risks to financial stability.

ESRB Recommendations and Warnings

The ESRB issues recommendations for remedial action when action is deemed necessary to appropriately address emerging systemic risks identified.

Recommendations can be addressed to the EU as a whole or to Member States, the European Commission, the European supervisory authorities, or national authorities. Compliance with the recommendations is assessed by the ESRB via an “act or explain” mechanism.

The following is a list of pertinent ESRB Recommendations which are of particular relevance from an MFSA perspective, albeit a comprehensive list of ESRB Recommendations can be found in the following website:

https://www.esrb.europa.eu/mppa/recommendations/html/index.en.html

Vulnerabilities in the Commercial Real Estate Sector in the EEA (ESRB/2022/9)

In order to ensure consistent treatment of certain risks across the financial system, the ESRB considers the introduction of activity-based tools with the aim of avoiding procyclical effects, stemming from the Commercial Real Estate (CRE) market, on the real economy and other segments of the financial sector. Accordingly, it is recommended that:

- the European Commission assesses the current macroprudential framework in the European Union and ensures that consistent rules for addressing risks related to CRE exposures are applied across all financial institutions when they perform the same activities, taking into account their specificities and specific risk profiles; and

- relevant authorities that have a role in financial stability continue to ensure that risks and vulnerabilities related to the CRE sector are adequately addressed (improving the monitoring of systemic risks stemming from the CRE market and ensuring that financial institutions providing financing for CRE have prudent risk management practices in place).

Related:

ESRB report Vulnerabilities in the EEA commercial real estate sector (January 2023)

Establishment of a Pan European Systemic Cyber Incident Coordination Framework (EU-SCICF) (2/12/2021)

In December 2021, the ESRB’s General Board adopted a recommendation for the establishment of a pan European systemic cyber incident coordination framework (EU SCICF). This recommendation reiterated that the speed and propagation of cyber incidents calls for a high level of preparedness and coordination among financial authorities in order to respond effectively to major cyber incidents. The proposed EU-SCICF would aim to strengthen such coordination among financial authorities in the EU, as well as with other authorities in the EU and key actors at international level. It would complement the EU’s existing cyber incident response frameworks by addressing risks to financial stability stemming from cyber incidents.

The ESRB also published in January 2022 a report entitled “Mitigating systemic cyber risk”, which explained how the EU-SCICF would facilitate an effective response to a major cyber incident. The report assessed the ability of the current macroprudential framework to address the risks and vulnerabilities stemming from systemic cyber risk. The ESRB concluded that the macroprudential mandates and toolkits of financial authorities needed to be expanded to include cyber resilience.

Restriction of Distributions During the COVID-19 Pandemic (15/12/2020)

This recommendation covers those actions by financial institutions that result in a reduction in the amount and quality of their own funds or in a reduction of their loss absorbing capacity for the duration of the coronavirus-related crisis.

Identifying legal entities (24/09/2020)

This recommendation is to propose the use of a common identification of legal entities established in the Union that are involved in financial transactions by way of a legal entity identifier (LEI), paying due regard to the principle of proportionality, taking into account the need to prevent or mitigate systemic risk to financial stability in the Union and thereby achieving the objectives of the internal market.

Minimum Requirements for National Monitoring Frameworks (27/05/2020)

This recommendation aims to national macroprudential authorities to collect Data to monitor and to assess financial stability implications of COVID-19 related measures of a fiscal nature taken by their Member States to protect the real economy.

Liquidity Risks Arising From Margin Calls (25/05/2020)

This recommendation aims to reduce the liquidity risks for CCPs. Sudden and significant (hence procyclical) changes and cliff effects in initial margins (including add-ons margins) and in collateral frameworks should be limited (i) by CCPs vis à vis members, and (ii) by clearing members vis à vis their clients.

Exchange and Collection of Information on Branches (26/09/2019)

This recommendation aims to ensure that macroprudential authorities have the power to require and obtain in a timely fashion the information from branches, where those branches are considered as relevant for financial stability in the country in which they operate, considered necessary for the adoption and/or activation of macroprudential policy measures.

Closing Real Estate Data Gaps (21/03/2019; 31/10/2016)

This recommendation aims to close remaining data gaps by establishing a more harmonised framework for monitoring developments in real estate markets in the EU. The recommendation provides a common set of indicators that national macroprudential authorities are recommended to monitor when assessing risks originating from the real estate sector, along with working definitions of those indicators.

For Residential Real Estate, by 31 December 2019, national macroprudential authorities are requested to deliver to the ESRB and the Council an interim report on the information already available, or expected to be available, for the implementation of the Recommendation. By 31 December 2020, a final report on the implementation of the Recommendation.

For Commercial Real Estate, by 31 December 2019, national macroprudential authorities are requested to deliver to the ESRB and the Council an interim report on the information already available, or expected to be available, for the implementation of the Recommendation. By 31 December 2021, a final report on the implementation of the Recommendation.

Where national macroprudential authorities do not have the relevant information in relation to the indicators referred to in ‘points (a) to (e)’ of Recommendation C(1) -Commercial Real Estate-, those authorities are requested to deliver to the ESRB and the Council a final report on the implementation of Recommendation on Commercial Real Estate in relation to those indicators at the latest by 31 December 2025.

Voluntary Reciprocity for Macroprudential Measures (15/12/2015)

RECOMMENDATION OF THE EUROPEAN SYSTEMIC RISK BOARD of 15 December 2015 on the assessment of cross-border effects of and voluntary reciprocity for macroprudential policy measures (ESRB/2015/2) – consolidated version

This recommendation provides guidance for a systematic assessment of the cross-border effects of macroprudential policy and a coordinated policy response in the form of voluntary reciprocity for macroprudential policy measures when needed. The arrangement for voluntary reciprocity aims to address cross-border effects of national macroprudential policy measures, which may have negative effects on the financial stability of the Union. The Recommendation is subject to amendments for the inclusion of macroprudential policy measures, the reciprocation of which has been requested by the relevant activating authority and subsequently recommended by the ESRB.

Recognising and Setting CCYB Rates for Exposures to Third Countries (11/12/2015)

List of Material Third Countries – (updated June 2022)

This recommendation aims to promote a coherent approach across the Union for recognising and setting countercyclical buffer (CCYB) rates for exposures of Member States’ domestic banking sectors to third countries in order to prevent an uneven playing field and the resulting incentives for regulatory arbitrage. The Recommendation is intended to ensure that designated authorities recognise CCYB rates set by third-country authorities, set CCYB rates for exposures to third countries and set lower CCYB rates when risks in a particular third country abate or materialise.

Jurisdictions should recognise each other’s countercyclical buffer rates. If an authority in one jurisdiction increases the countercyclical buffer rate to protect its domestic banking sector from excessive credit growth, authorities in other jurisdictions should apply the same countercyclical buffer rate to the exposures of their domestic banks to that country.

Designated Authorities are requested to report to the ESRB, the Council and the Commission the actions they have taken in response to this Recommendation, or justify any inaction.

Guidance for Setting CCYB Rates (18/06/2014)

This recommendation provides guidance to Member States on setting countercyclical buffer (CCB) rates with the aim of establishing a common approach across the Union. The Recommendation provides designated authorities with principles for assessing and setting CCB rates, and guidance on measuring and calculating the credit-to-GDP gap and on calculating the buffer itself.

Intermediate Objectives and Instruments of Macro-Prudential Policy (04/04/2013)

This Recommendation has the following four Recommendations (A, B, C, D):

A. Recommendation A is addressed to macroprudential authorities and recommends them to define and pursue intermediate objectives (IOs) of macroprudential policy in order to operationally facilitate the pursuit of the ultimate objective of macroprudential policy. The Recommendation sets out at least five IOs that should be defined and pursued by macroprudential authorities. These IOs relate to the market failures that macroprudential policy can address.

B. Recommendation B is addressed to Member States and recommends that they assess whether their macroprudential authorities have in place macroprudential instruments that are sufficient to pursue effectively and efficiently the ultimate objective and the IOs of macroprudential policy.

C. Recommendation C is a broad-ranging recommendation to macroprudential authorities to define a comprehensive and transparent policy strategy and conduct further analysis to strengthen their strategy based on the practical application of macroprudential instruments to foster decision making, communication and accountability. This should link the IOs and macroprudential instruments, and include indicators to monitor systemic risk and guide decisions on application, deactivation and calibration of time-varying instruments. It should also incorporate appropriate coordination mechanisms between the relevant national authorities and communication to the ESRB if national instruments are expected to have significant cross-border effects on other Member States.

D. Recommendation D recommends that macroprudential authorities periodically review their IOs and instruments, and adjust them if they are not sufficient. This has to take into account information learned about the effectiveness of instruments and changes in the prominent risks to financial stability at the national level.

Funding of Credit Institutions (20/12/2012; 21/03/2106)

Summary Compliance Report, updated November 2017

This recommendation provides guidance to supervisory authorities and the European Banking Authority (EBA) on incentivising sustainable funding structures for credit institutions and mitigating any related systemic risks. The Recommendation requires supervisory and macroprudential authorities to establish a monitoring framework for funding risks and asset encumbrance. It also recommends greater transparency about encumbered assets in the public reporting of banking institutions. Supervisory authorities are requested to identify best practices regarding covered bonds and encourage harmonisation of their national frameworks, while the EBA is recommended to assess whether financial instruments other than covered bonds could also generate encumbrance.

US Dollar Denominated Funding of Credit Institutions (22/12/2011)

Follow-up report – overall assessment, March 2015

This recommendation aims to prevent European banks being dependent on US dollar funding. National supervisory authorities are recommended to take preventive measures by monitoring maturity mismatches between assets and liabilities in US dollars and ensuring that banks have contingency plans in place for their US dollar funding.

National supervisory authorities are recommended to: 1) closely monitor US dollar funding and liquidity risks taken by credit institutions, as part of their monitoring of the credit institutions’ overall funding and liquidity positions, and 2) ensure that credit institutions provide for management actions in their contingency funding plans for handling a shock in US dollar funding, and that those credit institutions have considered the feasibility of those actions if more than one credit institution tries to undertake them at the same time.

Lending in Foreign Currencies (21/09/2011)

Follow-up Report – Overall assessment, May 2015

This recommendation aims to reduce the risks associated with financial institutions lending to households and companies in foreign currency. National supervisory authorities and Member States are recommended to require financial institutions to provide borrowers with adequate information on the risks associated with borrowing in foreign currency. National supervisory authorities are further recommended to monitor whether foreign currency lending is encouraging excessive credit growth and to ensure that financial institutions incorporate the risks associated with lending in foreign currency into their internal risk management.

National supervisory authorities, with regards to macroprudential assessment, are recommended:

- To monitor levels of foreign currency lending and of private non-financial sector currency mismatches and adopt the necessary measures to limit foreign currency lending.

- To monitor whether foreign currency lending is inducing excessive credit growth as a whole.

- To consider setting more stringent underwriting standards, such as debt service-to-income and loan-to-value ratios.

- To closely monitor funding and liquidity risks taken by financial institutions in connection with foreign currency lending, together with their overall liquidity positions. Particular attention should be paid to the risks related to: (a) any build-up of maturity and currency mismatches between assets and liabilities, (reliance on foreign markets for currency swaps (including currency interest rate swaps), (c) concentration of funding sources.

- To impose measures addressing foreign currency lending at least as stringent as the measures in force in the host Member State where they operate through provision of cross-border services or through branches. This recommendation applies only to foreign currency loans granted to borrowers domiciled in the host Member States.

The ESRB issues warnings when significant systemic risks are identified and when necessary to flag such risks.

Warnings can be addressed to the EU as a whole or to Member States, the European supervisory authorities, or national authorities. The ESRB will then monitor if, and to what extent, the systemic risk is addressed. Where appropriate, the ESRB will consider issuing a recommendation.

A comprehensive list of warnings issued by the ESRB can be found in the following website:

Research Papers

As part of the risk identification, monitoring and analytical assessments undertaken by the Financial Stability function within the MFSA, research studies are regularly carried out. Included here are downloadable reports and research papers which delve into various thematic that relate to financial stability.

25/01 – Liquidity Stress Testing for Maltese Retail Investment Funds: 2024 Update (May 2025)

Title: Liquidity Stress Testing for Maltese Retail Investment Funds: 2024 Update

Author: Stephanie Gauci

Ref no: 25/01

Date of publication: May 2025

This report presents the results of a liquidity stress testing exercise conducted on 74 Maltese retail investment funds, accounting for 94% of Maltese retail funds in terms of net asset value as of end-2023. The results indicate that most funds would experience low redemption pressures even under severe stress scenarios, with only three funds projected to face outflows exceeding 20% of NAV in the most adverse case. However, a decline in holdings of highly liquid assets indicates a higher vulnerability of some funds to liquidity shortfalls. The stress test identified eight funds that would be unable to meet redemption requests under certain scenarios, primarily due to exposures to foreign target funds – classified as illiquid under the adjusted HQLA methodology – and lower-rated corporate bonds. Despite these challenges, the overall impact of second-round redemption losses remains limited.

Liquidity Stress Testing for Maltese Retail Investment Funds: 2024 Update

24/01 – Liquidity Stress Testing for Maltese Retail Investment Funds: 2023 Update (January 2024)

Title: Liquidity Stress Testing for Maltese Retail Investment Funds: 2023 Update

Author: Stephanie Gauci

Ref no: 24/01

Date of publication: January 2024

This report summarizes the outcomes of the liquidity Stress Testing for Investment Funds Framework (STIFF) for a sample of retail investment funds in Malta, incorporating data up to the end of 2022 and applying the same methodology as the 2021 study. The results indicate an improvement in the liquidity positions of the sampled UCITS funds compared to the last two years’ stress tests. Under the most extreme scenario, only one fund may encounter liquidity challenges using either the Waterfall or Slicing liquidation approach. Additionally, the analysis reveals that second-round effects, both in terms of redemptions and liquidation costs, remain relatively limited.

Liquidity Stress Testing for Maltese Retail Investment Funds: 2023 Update

23/01 – Liquidity Stress Testing for Maltese Retail Investment Funds: 2022 Update (January 2023)

Title: Liquidity Stress Testing for Maltese Retail Investment Funds: 2022 Update

Author: Stephanie Gauci

Ref no: 23/01

Date of publication: January 2023

This report provides an update of the micro-level liquidity stress testing exercise for retail investment funds, using the methodology adopted in the study carried by the Authority in 2021. A sample of Maltese retail investment funds was considered in this exercise, covering data up to December 2021. From the outcomes of this study, it seems that the liquidity constraints brought about by the pandemic in 2020 have not morphed into more serious liquidity issues in 2021 in the Maltese retail funds sector. Indeed, stress testing results show that whilst some Maltese retail funds are no longer maintaining high cash and near cash assets as a defensive strategy, concerns related to their capacity of meeting redemption requests remain very minimal (in terms of number of funds) under the most extreme scenario, adopting both the waterfall and slicing approaches.

Liquidity Stress Testing for Maltese Retail Investment Funds: 2022 Update

21/04 – Liquidity Stress Testing for Maltese Retail Investment Funds: 2021 Update (December 2021)

Title: Liquidity Stress Testing for Maltese Retail Investment Funds: 2021 Update

Authors: Stephanie Gauci and Francesco Meglioli

Ref no: 21/04

Date of publication: December 2021

The main purpose of this report is to provide an update, at a micro level, of the liquidity stress testing of investment funds carried out for the first time by the Authority in 2020. While most of the methodology remains unchanged, some modifications are applied to overcome certain shortcomings that emerged in the previous framework. Overall, we find that the liquidity risk in the Maltese retail investment fund industry remains contained, with most of the funds capable of withstanding extreme redemption requests. Moreover, the Covid-19 pandemic provided a perfect opportunity to test the validity of the model calibrated in 2020. We find that the extreme redemptions calibrated in the previous stress testing exercise provided a reliable estimate of the redemption magnitudes which a fund manager could expect during turbulent years such as 2020.

Liquidity Stress Testing for Maltese Retail Investment Funds: 2021 Update

21/03 – Climate Transition Risk: Quantifying the Impact of Carbon Taxation on the Investment Portfolio of Financial Institutions (November 2021)

Title: Climate Transition Risk: Quantifying the Impact of Carbon Taxation on the Investment Portfolio of Financial Institutions

Authors: Giorgia Conte and Francesco Meglioli

Ref no: 21/03

Date of publication: November 2021

This study aims to contribute to the growing strand of literature on climate transition risk by estimating the short-term implications of a carbon taxation on the investment portfolios of the Maltese financial system. Adopting a static balance sheet assumption, this research study quantifies the financial losses arising on the investment portfolio (excluding government bond) following the possible implementation of a carbon tax. These losses are assessed from different perspectives, with results presented on a financial instrument level and also at industry and entity levels. It is observed that losses driven by climate transition through the simulations would overall be limited. The investment portfolio of the Maltese financial sector appears to be resilient to the introduction of a carbon tax, albeit a few institutions could experience noteworthy losses.

21/02 – Domestic Insurance Stress Test (October 2021)

Title: Domestic Insurance Stress Test

Authors: Flavio Senatore and Anna Bonello

Ref no: 21/02

Date of publication: October 2021

The Domestic Insurance Stress Test represents the first step by the MFSA’s Financial Stability function to assess the domestic insurance sector resilience to an adverse scenario, triggered by an interest rate shock. Insurance undertakings’ vulnerabilities are assessed from a macro-prudential perspective, complementing other macro- and micro- risk oversight metrics applied within the Authority. In particular, the stress test tool presents a stand-alone assessment of insurance undertakings, assuming no financial support within the group structure or from the parent company. The framework is based on a Grouped t-Copula approach, with a Conditional Value-at-Risk (CoVaR) metric applied to calibrate and shape the scenario. Findings indicate that in a protracted period of extremely low interest rates, the post-stress assets-over-liabilities indicator is negatively impacted. Specifically, this is mainly driven by a surge in technical provisions (liabilities), accompanied by declines incurred within asset classes such as equities and CIUs, which exceed the gains observed on bond prices.

21/01 – A Multi-level Network Approach to Spillovers Analysis: An Application to the Maltese Domestic Investment Funds Sector (August 2021)

Title: A Multi-level Network Approach to Spillovers Analysis: An Application to the Maltese Domestic Investment Funds Sector

Authors: Francesco Meglioli and Stephanie Gauci

Ref no: 21/01

Date of publication: August 2021

This paper presents a new approach to analyse the interconnectedness between a macrolevel network and a local-level network. The methodology is developed on the Diebold and Yilmaz connectedness measure and it considers the presence of entities within a global network which can influence other entities within their own local network but are not relevant enough to influence the entities which do not belong to the same local network. This methodology is then applied to the Maltese domestic investment funds sector finding that a high-level correlation between the domestic funds can transmit higher spillovers to the local stock exchange index and to the government bond secondary market prices. Moreover, a high correlation among the Maltese domestic investment funds can increase their vulnerability to shocks stemming from financial indices, and therefore, investment funds may potentially become a shock transmission channel.

20/06 - Liquidity Stress Testing for Maltese Retail Investment Funds (November 2020)

Title: Liquidity Stress Testing for Maltese Retail Investment Funds

Authors: Francesco Meglioli and Stephanie Gauci

Ref no: 20/06

Date of publication: November 2020

The Stress Testing for Investment Funds Framework (STIFF) is a first attempt by the Financial Stability function within the Malta Financial Services Authority to develop a liquidity stress testing framework, both at micro and macro levels, for a sample of 64 Maltese retail investment funds. The micro-level stress test assesses the resilience of the individual investment funds to extreme but plausible weekly redemption shocks, from which we find that only one fund out of a sample of 64 Maltese retail funds failed the stress test under three different levels of redemption requests and under both the waterfall and slicing liquidation approaches. On the other hand, the macro-level stress test is used to gauge a deeper insight on how the macro-economic environment can affect the liquidity profile of the Maltese fund industry, and to identify the types of funds which are most exposed to macro-economic shocks. We find that funds classified under the other and the mixed categories are the most exposed to shocks in the real economy.

Liquidity Stress Testing for Maltese Retail Investment Funds

20/05 - Assessing Contagion Risk in The Maltese Financial Sector: A Network Model Approach (September 2020)

Title: Assessing Contagion Risk in the Maltese Financial Sector: A Network Model Approach

Authors: Theresa Fenech and George Zahra

Ref no: 20/05

Date of publication: September 2020

Linkages between financial institutions can amplify the effects of an adverse shock significantly, with the possibility of becoming systemic. In light of this, the Financial Stability function within the MFSA, developed a financial sector network model that allows an in-depth assessment of contagion risk within Malta’s financial system. The network methodology closely mirrors other works in the field, with the novelty being the unique data set used to test the model empirically. Using supervisory data, it was possible to estimate the model and carry out a number of simulations on a network made up of three different types of institutions: banks, insurance undertakings and investment funds which are linked together through a number of bi-lateral exposures.

The flexibility embedded within the model allows simulations of default within a single or group of institutions, identifying how this failure impacts other institutions through the equity, credit and funding channel mechanisms. These channels operate in the context of a sequential default mechanism, similar to that used by Espinosa-Vega and Sole (2010) and Covi, Gorpe and Kok (2019). Although simulation results are subject to significant simplifications, they give interesting insights for policy makers and supervisors. Additionally, network metrics are established, notably the systemic relevance, systemic fragility and the loss amplification factor, which increase the usability of the network model for risk oversight purposes, allowing identification of institutions which pose the highest risk on financial stability.

Assessing Contagion Risk in the Maltese Financial Sector: A Network Model Approach

20/04 - Covid-19 and The Property Rental Market (July 2020)

Title: COVID-19 and the Property Rental Market

Author: Theresa Fenech

Ref no: 20/04

Date of publication: July 2020

The impact arising on the property rental market during the COVID-19 pandemic is innovatively assessed by drawing upon public data sources that gauge property price developments in real time. The picture that emerged is that during the first quarter of 2020, the pandemic created imbalances particularly in the holiday rental market segment, given the travel disruptions and social distancing measures. The findings point towards a sudden reversal in the local rental market trajectory, which was growing consistently over the past years.

20/03 - Non-Bank Financial Intermediation in Malta (June 2020)

Title: Non-Bank Financial Intermediation in Malta

Authors: Christopher P. Buttigieg, Mariana Gkoutse and Theresa Fenech

Ref no: 20/03

Date of publication: June 2020

This is an Accepted Manuscript of an article published by Taylor & Francis in Law and Financial Markets Review on the 7th of June 2020, available online.

The paper presents a first estimate of the size of the non-bank financial intermediation (NBFI) in Europe’s smallest member state as well as the regulatory implications for its monitoring. The assessment is based on the narrowing-down approach introduced by the Financial Stability Board. Results show that although the broad measure of NBFI is large, the actual NBFI perimeter is rather small, dominated by the locally-based investment funds. The paper also provides an extensive review of the EU and national regulatory framework within which NBFI entities operate, listing also the challenges arising from this sector.

Based on extensive research and analysis of information from various reports, articles, web-sites and other sources referenced throughout the paper, it transpires that NBFI in Malta is not only small, but also subject to significant EU and national regulation. Given the benefits that the real economy could gain from NBFI, the main challenge for the regulators is to strike a balance between the optimisation of their benefits and the minimisation of potential losses due to the build-up of risks emanating from this sector.

20/02 - Insurance Investment Behaviour Report (March 2020)

Title: Insurance Investment Behaviour Report

Author: Mirko Mallia, Anna Bonello and Karine La Ferla

Ref no: 20/02

Date of publication: March 2020

Investment return yields have been on a declining trend for some time, causing financial institutions to face increased profitability and solvency pressures. The insurance sector, although generally better equipped to withstand long periods of low interest rates, is still vulnerable to such influences. This report focuses on providing an overview of the developments in investment allocation of the domestically relevant insurance undertakings between 2016 and 2018. The analysis delves into several attributes of each investment category; including credit ratings, maturity and country of issuance. In order to provide a more in-depth view when analysing investment behaviour, the report contains responses received from a survey which was circulated amongst the undertakings in September 2019. The survey delved into the risk profile of the undertakings, investment portfolio trends, forward looking plans, and guaranteed products.

20/01 - Trends and Risks in The Maltese AIFMS (February 2020)

Title: Trends and Risks in the Maltese AIFMs

Author: Tony Farrugia, Andre Borg and Francesco Meglioli

Ref no: 20/01

Date of publication: February 2020

The report provides findings from an analysis carried out on data submitted by Alternative Investment Fund Managers (AIFMs) in accordance with Directive 2011/61/EU. The objective of this study is to identify trends and risks of the Alternative Investment Funds (AIFs) reporting to the MFSA, as well as uncovering data inconsistencies in the AIFM statistical returns, an issue which continues to be persistent across all reporting countries including Malta. The analysis carried out in the report is split into two main parts. The first part provides a statistical overview of the Maltese AIFM industry, while the second part delves into a risk analysis carried out on the historical values of different risk indicators reported by the AIFMs. The analysis indicates that the risk in the AIFs reporting in Malta generally diminished during 2018, with only a small number of locally managed AIFs employing leverage.

19/01 - Systemic Risk - The Maltese Banking Industry’s Perception (December 2019)

Title: Systemic Risk – The Maltese Banking Industry’s Perception

Author: Mirko Mallia, Ian Buttigieg and Tomasz Kolbuszewski

Ref no: 19/01

Date of publication: December 2019

The events leading to the onset of the financial crisis more than a decade ago have led the international community to devote significant resources towards the analysis of systemic risk. An online survey titled ‘Malta Financial Services Authority survey on Systemic risk 2019’, carried out by the Financial Stability function, was one of the recent initiatives aimed at gauging the banking sector’s views of risks and their confidence in the stability of Malta’s financial system. The survey was circulated across all active credit institutions being licensed in Malta at the time. The feedback from credit institutions formed the basis of the report outlining the most prevalent risks as identified by the banking industry, both in terms of perceived probability of risk materialisation, as well as their possible consequences on the financial system and the institutions’ capacity to cope with the outcomes if a systemic risk occurs. Findings from the report identify a certain level of heterogeneity in risk gradings in view of differences in banks’ size and business models, diverse linkages to local and foreign economies, and adaptability to changing economic circumstances. This notwithstanding, banks have recognised a number of common concerns about certain categories of risk sources.