A recent study conducted by the Malta Financial Services Authority (MFSA) has shed light on the state of digital transformation and FinTech adoption within the Maltese financial services sector. In July 2022, the MFSA conducted a comprehensive study among 390 Authorised Entities or Persons holding a total of 472 licenses. With a high response rate of 95%from surveyed entities, the study aimed to gain insights into the adoption of enabling technologies and innovations, identify objectives behind digital transformation strategies, and evaluate perceived risks and impacts.

Key Findings

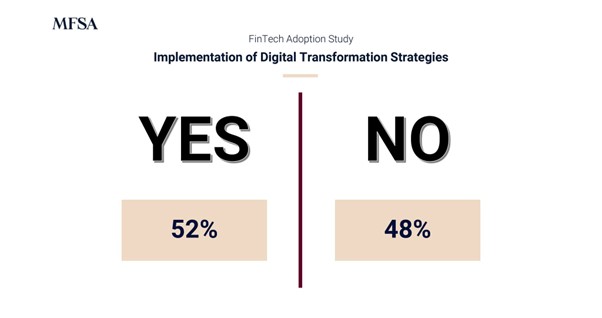

Over 50% of the surveyed financial services entities in Malta have taken actions toward digitisation, digitalisation, or the implementation of enabling technologies and innovations.

These entities, referred to as Active APs, have cited efficiency, enhanced customer experience, and engagement, as well as the reduction of operational risks as their main objectives for adopting digital transformation strategies. Several factors within the Maltese context influence the state of digital transformation and FinTech adoption. Access to the European Single Market, availability and access to adequate IT infrastructure, and the Maltese regulatory openness and accessibility were identified by surveyed entities as the top three factors positively influencing this space. Payment services, payment infrastructures, and commercial banking were identified as the main areas influenced by digital transformation.

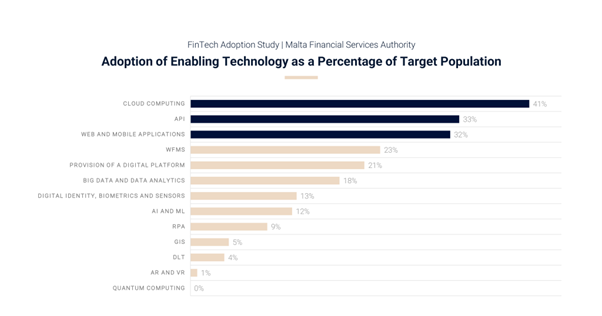

Adoption of Enabling Technologies

Cloud computing, Application Programming Interfaces (APIs), and web and mobile applications emerged as the main enabling and innovative technologies adopted by the Maltese financial services entities. These technologies were recognised for their positive impact on the overall financial services sector, particularly in areas such as payment services, payment infrastructures, and commercial banking.

Regulatory Technology (RegTech) and Risk Perception

A significant number of respondents confirmed the use of Regulatory Technology solutions, with a particular focus on Anti-Money Laundering (AML) and Counter Terrorism Financing (CTF) purposes.

Perceived Impact and Risks

According to respondents, the adoption of enabling and innovative technologies had an overall positive impact on the financial services sector. The study highlighted the potential for increased efficiency, enhanced customer experiences, a reduction in operational risks and the contribution to the sector's evolution and growth.

The adoption of cloud computing, big data and data analytics, and APIs had the highest positive effects on the overall financial services landscape.

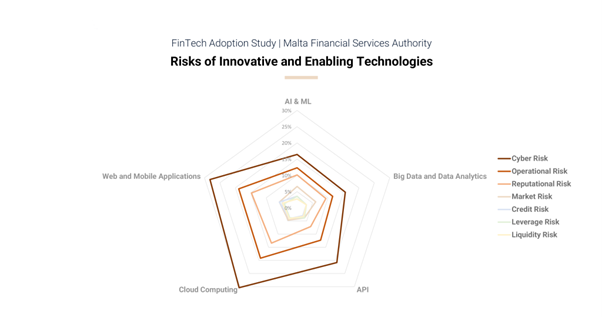

While cyber risk was perceived as the highest level of risk, respondents perceived the increase in risk as low, indicating no immediate threats to financial stability.

The MFSA's study on digital transformation and FinTech adoption in Malta's financial services sector provides valuable insights into the state of innovation in the industry. The Authority remains committed to monitoring and understanding the implications of innovative technologies in financial services.

View the full report of the study here. Further discussions and inquiries on potential digital finance and FinTech initiatives can be directed to [email protected].