The Authorisations Process

The MFSA is the competent authority in Malta responsible for granting authorisation to persons seeking to carry out financial services activities. Authorisation is an important part of the overall supervisory framework.

The authorisation process of entities seeking to enter the financial services industry is a key function of the Malta Financial Services Authority in its gatekeeper role. The objective of the assessment of an application for authorisation is to ensure that criteria detailed under the respective financial services legislation are satisfied at authorisation stage and continue to be fulfilled on an ongoing basis.

Who Needs an Authorisation?

The Authorisation Unit is responsible for the processing of applications, changes in control and appointment of approved persons, requests for changes in documentation, waiver/exemption applications as well as passporting notifications under the relevant EU/EEA Directives.

Understanding Our Authorisation Process

The applicant is invited to submit an application pack which should contain the complete set of required documents in accordance with the authorisation applied for.

The Personal Questionnaire

Prior regulatory approval is required before a person takes up a position which can influence the direction of an Entity, or occupies certain positions of trust. Approval is subject to a due diligence process by the MFSA to ensure that the Applicant meets the ‘fit and proper’ or suitability criteria and has the necessary qualities to perform the responsibilities required in his/her position.

The Corporate Questionnaire

The Corporate Questionnaire shall be duly filled in by Qualifying Shareholders or Other Controllers (‘Qualifying Holder’) which have legal personality and are being proposed as an Involvement with an Applicant or Authorised Person.

The MFSA’s Authorisations Catalogue

The MFSA is committed to providing a clear, open and transparent authorisation process while ensuring a rigorous assessment of the applicable regulatory standards.

The requested documentation is listed in the applicable application form for the specific category of licence or recognition in the Authorisations Catalogue below.

Banking

Investment Services

Capital Markets

Insurance, Pensions and Intermediaries

Company Service Providers

Financial Institutions

Crypto-Assets

Trustees & Other Fiduciaries

Banking

Credit Institutions

Credit institutions are entities licensed to operate under the Banking Act (Cap. 371 of the Laws of Malta). According to the Banking Act, a credit institution can undertake a number of activities which are specified in the Schedule to the same Act.

The business of banking is the taking of deposits of money from the public from retail customers for the purpose of employing, lending or investing such money.

Credit Servicers

Credit servicers are defined as legal persons that, in the course of their business, manage and enforce the rights and obligations related to a creditor’s rights under a non-performing credit agreement, or to the non-performing credit agreement itself, on behalf of a credit purchaser.

Credit servicers are licensed to operate under the Credit Servicers and Credit Purchasers Act (Chapter 645 of the Laws of Malta).

Investment Services

Investment Firms

Investment firm is defined as any legal person whose regular occupation or business is the provision of one or more investment services to third parties and/or the performance of one or more investment activities on a professional basis.

These Investment Firms are licensed to operate under the Investment Services Act (Cap. 370 of the Laws of Malta).

Application

Revised Applications in accordance with the New Authorisation Process (upload via LH Portal)

MiCA Notification Form

Passporting

Schedule D – Provision of Cross-Border Services under Freedom to Provide Services

Schedule E – Provision of Cross-Border via the Establishment of a Branch

Fund Management

Any scheme or arrangement which has as its object or as one of its objects the collective investment of capital acquired by means of an offer of units for subscription, sale or exchange and which has a set of characteristics as specified in the Investment Services Act.

Investment Services Providers are regulated in terms of the Investment Services Act (Cap. 370 of the Laws of Malta) and include:

i) MiFID Firms;

ii) Alternative Investment Fund Managers (AIFMs) and UCITS Management Companies, collectively referred to as Investment Managers;

iii) Custodians.

Application

Revised Applications in accordance with the New Authorisation Process (upload via LH Portal)

Other Applications (upload via LH Portal)

MiCA Notification Form

Passporting

Schedule D – Provision of Cross-Border Services Under Freedom to Provide Services

Schedule E – Provision of Cross-Border Services via the Establishment of a Branch

Fund Administrator

Any scheme or arrangement which has as its object or as one of its objects the collective investment of capital acquired by means of an offer of units for subscription, sale or exchange and which has a set of characteristics as specified in the Investment Services Act.

Investment Services Providers are regulated in terms of the Investment Services Act (Cap. 370 of the Laws of Malta) and include:

i) MiFID Firms;

ii) Alternative Investment Fund Managers (AIFMs) and UCITS Management Companies, collectively referred to as Investment Managers;

iii) Custodians.

Funds

Any scheme or arrangement which has as its object or as one of its objects the collective investment of capital acquired by means of an offer of units for subscription, sale or exchange and which has a set of characteristics as specified in the Investment Services Act.

Investment Services Providers are regulated in terms of the Investment Services Act (Cap. 370 of the Laws of Malta) and include:

i) MiFID Firms;

ii) Alternative Investment Fund Managers (AIFMs) and UCITS Management Companies, collectively referred to as Investment Managers;

iii) Custodians.

Application

Undertakings Collective Investments in Transferable Securities

Revised Applications in accordance with the New Authorisation Process (upload via LH Portal)

Other Applications (upload via LH Portal)

Passporting

Alternative Investment Funds

Revised Applications in accordance with the New Authorisation Process (upload via LH Portal)

Other Applications (upload via LH Portal)

Passporting

Professional Investor Funds

Revised Applications in accordance with the New Authorisation Process (upload via LH Portal)

Other Applications (upload via LH Portal)

Notified Alternative Investment Funds

Other Applications (upload via LH Portal)

Notified Professional Investor Funds

Other Applications (upload via LH Portal)

Custodians / Depositaries

Any scheme or arrangement which has as its object or as one of its objects the collective investment of capital acquired by means of an offer of units for subscription, sale or exchange and which has a set of characteristics as specified in the Investment Services Act.

Investment Services Providers are regulated in terms of the Investment Services Act (Cap. 370 of the Laws of Malta) and include:

i) MiFID Firms;

ii) Alternative Investment Fund Managers (AIFMs) and UCITS Management Companies, collectively referred to as Investment Managers;

iii) Custodians.

Application

Revised Applications in accordance with the New Authorisation Process (upload via LH Portal)

MiCA Notification Form

Recognised Persons

Recognised Persons are legal persons established in Malta and which are issued with a Recognition Certificate in terms of the Investment Services Act (Cap. 370 of the Laws of Malta).

Such legal persons are:

(i) Fund Administrators

(ii) Recognised Incorporated Cell Companies

(iii) Private Collective Investment Schemes

Capital Markets

- Trading Venues

- Securitisation

- Crowdfunding

- Data Reporting Service Providers

- DLT Market Infrastructures

- Benchmarks

Trading Venues

Regulated markets are multilateral systems operated and / or managed by a market operator, which bring together or facilitate the bringing together of multiple third-party buying and selling interests in financial instruments – in the system and in accordance with its non-discretionary rules – in a way that results in a contract, in respect of the financial instruments admitted to trading under its rules and, or systems, and which is authorised and functions regularly and in accordance with Title III of MiFID.

Regulated Markets are regulated in terms of the Financial Markets Act (Cap. 345 of the Laws of Malta).

Application

MiCA Notification Form

Securitisation

Securitisations are transactions or arrangements undertaken by securitisation vehicles, including securitisation cell companies, to issue financial instruments in order to directly or indirectly, and in whole or in part, finance the acquisition of securitisation assets from originators by any means, or the assumption of risks from originators by any means, or the granting of secured loans or other secured facilities to originators.

Securitisations regulated in terms of the Securitisation Act (Cap. 484 of the Laws of Malta).

Crowdfunding

Crowdfunding Service Provider is defined as any legal person whose regular occupation or business is matching of business funding interests of investors and project owners through the use of a crowdfunding platform.

These Crowdfunding Service Providers are licensed to operate under the European Crowdfunding Service Providers Regulation (Regulation (EU) 2020/1503 of the European Parliament and of the Council of 7 October 2020).

Data Reporting Service Providers

Data reporting services providers (DRSPs) enhance transparency and effective supervision of financial markets, enabling investors and national competent authorities (NCAs) to receive accurate and comprehensive trading data.

Regulation (EU) No 600/2014 on markets in financial instruments (MiFIR), as amended by Regulation (EU) 2019/2175 (ESAs review), provides the following categories of DRSPs:

• approved reporting mechanisms (ARMs): entities providing the service of reporting details of transactions to competent authorities or to ESMA on behalf of investment firms

• approved publication arrangements (APAs): entities providing the service of publishing trade reports on behalf of investment firms

• consolidated tape providers (CTPs): entities providing the service of collecting trade reports from trading venues and APAs, consolidating them into a continuous electronic live data stream providing price and volume data per financial instrument.

MiFIR (as amended by the ESAs Review) envisages that - starting from 1 January 2022 - ESMA is granted direct responsibilities regarding the authorisation and supervision of DRSPs, except for those APAs and ARMs that fall under a derogation.

MiFIR).

DLT Market Infrastructures

As part of the EU’s Digital Finance Package a regulation on a pilot regime for market infrastructures based on distributed ledger technology (DLT) was established. DLT Market Infrastructures can be categorised in any of the following structures, namely: DLT Multilateral Trading Facilities; DLT Settlement Systems; or DLT Trading and Settlement Systems. DLT Market Infrastructures can request limited exemptions from specific requirements under other EU legislations such as MiFID II and CSDR, provided they comply with the conditions attached to those exemptions and compensatory measures requested by the MFSA. The permission to operate a DLT Market Infrastructure may come in addition to an authorisation as a CSD or trading venue or can be granted to new entrants that will have to meet the relevant MiFID II and/or CSDR requirements, except those for which the applicant requests, and has been granted, an exemption.

DLT Market Infrastructures are governed by Regulation (EU) 2022/858 of the European Parliament and of the Council of 30 May 2022 on a pilot regime for Market Infrastructures based on Distributed Ledger Technology, and amending Regulations (EU) No 600/2014 and (EU) No 909/2014 and Directive 2014/65/EU.

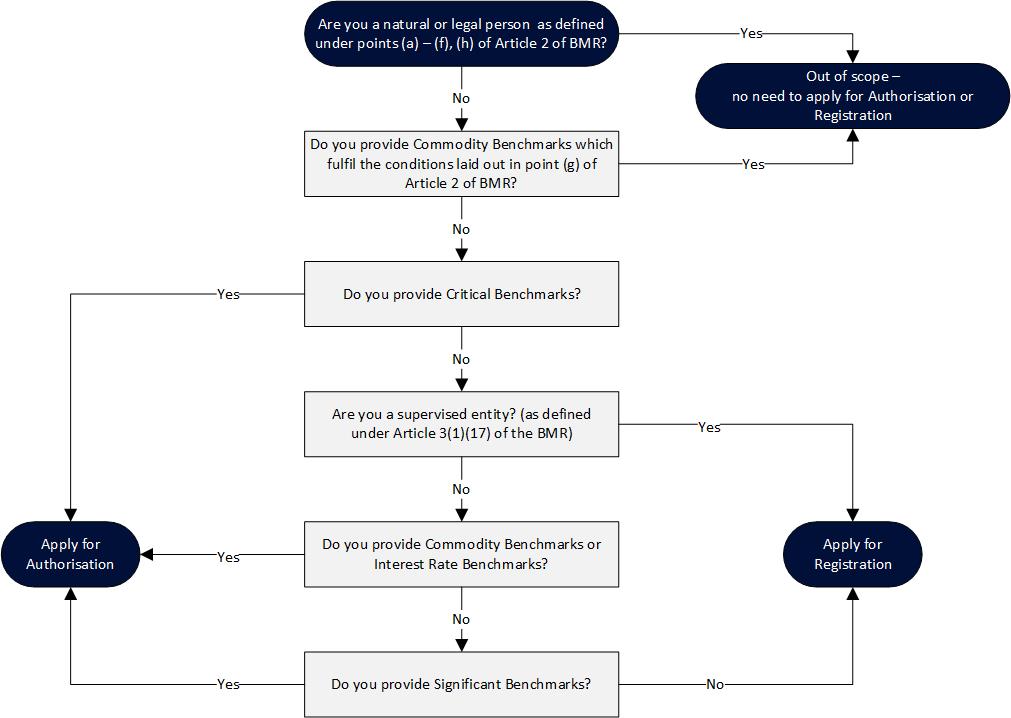

Benchmarks

In terms of Article 3(1)(5) of Regulation (EU) 2016/1011 of the European Parliament and of the Council of 8 June 2016 on indices used as benchmarks in financial instruments and financial contracts or to measure the performance of investment funds (the ‘Regulation’/’BMR’)), a benchmark administrator is defined as a natural or legal person who has control over the provision of a benchmark.

Pursuant to Article 34 of the BMR, administrators must apply for authorisation from or registration with the MFSA. The application forms for authorisation and registration as an administrator can be accessed below.

Insurance, Pensions and Intermediaries

- (Re) Insurance Undertakings

- Retirement Scheme Administrator

- Personal Retirement Schemes

- Occupational Retirement Schemes

- Other Service Providers - Custodian & Investment Manager

- Retirement Funds

- Insurance Intermediaries

(Re) Insurance Undertakings

This section applies to legal persons seeking to establish an Insurance Undertakings, a Reinsurance Undertaking or a Captives in terms of the Insurance Business Act (Cap. 403 of the Laws of Malta) (“IBA”) and pursuant to Article 7 of the IBA to carry on direct or reinsurance general business and, or long term business.

Application

Retirement Scheme Administrator

This section applies to Legal Persons seeking to obtain registration to perform duties of a Retirement Scheme Administrator in terms of the Retirement Pensions Act (Cap. 514 of the Laws of Malta).

Personal Retirement Schemes

A Personal Retirement Scheme is a scheme established for the principal purpose of providing Retirement Benefits. This section applies to Retirement Scheme Administrators seeking to establish a Personal Retirement Scheme in terms of the Retirement Pensions Act (Cap. 514 of the Laws of Malta).

Occupational Retirement Schemes

An Occupational Retirement Scheme is a scheme established for the principal purpose of providing Retirement Benefits in the context of an occupational activity. This section applies to Retirement Scheme Administrators seeking to establish an Occupational Retirement Scheme to in terms of the Retirement Pensions Act (Cap. 514 of the Laws of Malta).

Application

Revised Applications in accordance with the New Authorisation Process (upload via LH Portal)

Passporting

Other Service Providers – Custodian & Investment Manager

This section applies to legal persons seeking registration to carry out the Custody and Investment Management functions in terms of the Retirement Pensions Act (Cap. 514 of the Laws of Malta)

Application

Retirement Funds

Retirement Funds are arrangements established for the principal purpose of holding and investing contributions made to one or more retirement schemes and/or overseas retirement schemes. This section applies to Retirement Scheme Administrators seeking to establish a Retirement fund in terms of the Retirement Pensions Act (Cap. 514 of the Laws of Malta).

Insurance Intermediaries

Insurance Agents, Insurance Managers, Insurance Brokers, Tied Insurance Intermediaries and Ancillary Insurance Intermediaries are regulated by the Insurance Distribution Act, regulations issued thereunder, and the Insurance Distribution Rules and Conduct of Business Rules made by the MFSA.

Application

Revised Applications in accordance with the New Authorisation Process (upload via LH Portal)

Passporting

Company Service Providers

Company Service Providers

As defined in the Company Service Providers Act, Company Service Providers are those persons, other than Limited Company Service Providers, who by way of business provide Company Service, namely, the incorporation of companies and other legal entities, acting or arranging for another person to act as director or company secretary, and providing registered office services to third parties.

These service providers are regulated by the Company Service Providers Act.

Limited Company Service Providers

A Limited Company Service Provider refers to a natural person who by way of business holds himself out as acting as a director and/or a company secretary in a company, and/or a partner in a partnership, and/or in a similar position in relation to other legal entities and does not to have more than ten (10) Involvements at any point in time.

Restricted Company Service Providers

A Restricted Company Service Provider refers to a natural person who acts as a director and/or company secretary and/or a partner, or in a similar capacity within a legal entity, without providing such services by way of business.

Financial Institutions

- Financial Institutions

- Limited Network Exclusion

- Electronic Communication Exclusion

- Local or Third-Country Branches, Agents or Distributors for Maltese Financial Institutions

Financial Institutions

Financial Institutions are entities licensed to operate under the Financial Institutions Act (Cap. 376 of the Laws of Malta) and means a person who regularly and habitually undertakes the carrying out of the activity listed in the First Schedule thereof.

Financial Institutions fall within two broad categories:

i) Financial Institutions undertaking other activities such as lending, financial leasing, the provision of guarantees and commitments, foreign exchange services and money brokering;

ii) Institutions undertaking payment services and/or the issuance of electronic money (more commonly known as ‘payment institutions’ or ‘electronic money institutions’, respectively).

Limited Network Exclusion

Limited Network Exemption (Article 3(2A) paragraph (k)) Article 3(2A) of the Financial Institutions Act (Cap. 376) establishes that persons which carry out certain activities (as listed therein) are exempt from having to obtain a licence under the Act.

Within the above context, service providers which provide services based on specific payment instruments that can be used only in a limited way (‘Limited Network Exemption’) may be considered exempt if certain conditions are satisfied.

Electronic Communication Exclusion

Electronic Communications Exemption (Article 3(2A) paragraph (l))

Article 3(2A) of the Financial Institutions Act (Cap. 376) establishes that persons which carry out certain activities (as listed therein) are exempt from having to obtain a licence under the Act.

Within the above context, payment transactions by a provider of electronic communications networks or services, provided in addition to electronic communication services for a subscriber to the network or service (‘Electronic Communications Exemption’) may be considered exempt if certain conditions are satisfied.

Local or Third-Country Branches, Agents or Distributors for Maltese Financial Institutions

Application

Maltese Financial Institutions Engaging an Agent Locally or in a Third-Country

In accordance with Article 8A (1) of the Financial Institutions Act (Cap. 376) (‘the Act’) a financial institution intending to provide any of the activities referred to in the Schedules to the Act through an agent shall communicate certain information to the Authority. The Authority shall subsequently determine whether to enter the agent in the register referred to in Article 8D of the Act. Moreover, in accordance with Article 8A (7) a financial institution intending to provide its activities through an agent in a third country shall require the prior written approval of the Authority.

Maltese Financial Institutions appointing a Distributor Locally

In accordance with Article 8A (1) of the Financial Institutions Act (Cap. 376) (‘the Act’) an electronic money institution intending to appoint a distributor to distribute or redeem electronic money, shall communicate certain information to the Authority.

Maltese Financial Institutions Opening a Branch Locally or in a Third-Country

In accordance with Article 8(1) of the Financial Institutions Act (Cap. 376) (‘the Act’) a financial institution, other than those exercising a European right, shall inform the Authority in writing, before opening a new branch in Malta. Moreover, in accordance with Article 8(2) of the Act, a financial institution intending to open a branch outside Malta to provide any of the activities listed in the First Schedule, with the exception of activities 4 or 10 thereof, and a financial institution intending to open a branch in a third country in order to provide any of the activities listed in the First Schedule, shall require the prior written approval of the Authority.

Crypto-Assets

- Crypto-Assets Whitepaper

- Crypto-Asset Service Provider

- Issuers of Asset-Referenced Tokens

- Cross-Border Services

Crypto-Assets Whitepaper

Persons wishing to seek admission to trading of a crypto-asset other than an asset-referenced token or e-money token in terms of Article 4 or 5 of the Markets in Crypto-Assets Regulation shall be required to submit the below Other Crypto-Asset Whitepaper Form and supporting documentation via the LH Portal.

Persons seeking to notify a whitepaper relating to the issuance of electronic money tokens (EMTs) in terms of Article 51(11) of the MiCA Regulation shall submit their whitepaper, along with the EMT Whitepaper Form, to [email protected]. EMT whitepapers may only be notified by persons duly authorised in terms of the Financial Institutions Act.

Whitepapers relating to the issuance of asset-referenced tokens (ARTs) shall be submitted as part of the authorisation process applicable to issuers of ARTs.

Crypto-Asset Service Provider

Persons wishing to obtain authorisation to provide one or more crypto-asset services in terms of Article 59 of the Markets in Crypto-Assets Regulation are required to apply for a licence by submitting the CASP Application Form through the LH Portal.

Beneficial Owners, Qualifying Holders, Administrators and Senior Managers of the Applicant are required to submit a PQ prior to the submission of the Application Form. The Application Form needs to be accompanied by Annexes which may be accessed through the links below.

Issuers of Asset-Referenced Tokens

Persons wishing to offer asset-referenced tokens to the public or admit asset-referenced tokens to trading are required to apply for a licence by submitting the Issuer of Asset-Referenced Tokens application form.

Beneficial owners, qualifying holders, directors and senior managers of the Applicant Issuer are required to submit a PQ prior to the submission of the application form. The application form needs to be accompanied by Annexes which may be accessed through the links below.

Whitepapers relating to the issuance of asset-referenced tokens (ARTs) shall be submitted as part of the authorisation process applicable to issuers of ARTs.

Cross-Border Services

Crypto-asset service providers intending to offer services across multiple Member States under Article 65 of the Markets in Crypto-Assets Regulation must notify their home Member State’s competent authority. Crypto Asset Service Providers are required to apply for a licence by submitting the CASP Cross-Border Application Form through the LH Portal.

For more information on the framework please visit... Crypto-Assets

Trustees & Other Fiduciaries

Trustee / Fiduciary Services

The MFSA regulates professional trustees and other fiduciary service providers such as persons acting as mandataries and administrators of private interest foundations. These are required to be licensed and regulated in terms of the Trusts and Trustees Act.

Family Trustees

Trustees of Family Trusts are subject to a specific registration process by the MFSA and are also regulated in terms of the Trusts and Trustees Act.

Notaries acting as Qualified Persons

Notaries may apply for registration to be able to act as a qualified person for trustees who are not authorised by the MFSA in relation to the holding of securities or interests in or issued by a commercial partnership registered in Malta, or immovable property in Malta.

The appointment of a qualified person is regulated in terms of the Trusts and Trustees Act and a specific Legal Notice (SL 331.05) has been issued catering for the registration of notaries as qualified persons.